Charitable Gift Annuity Minimum Age

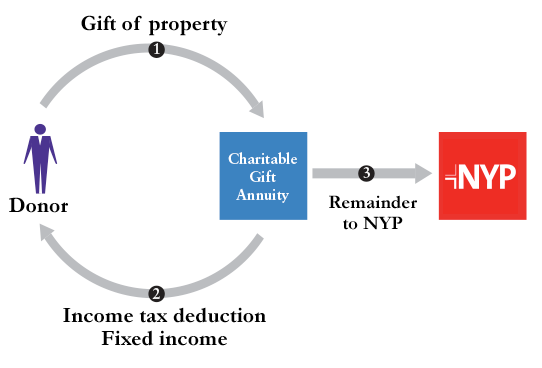

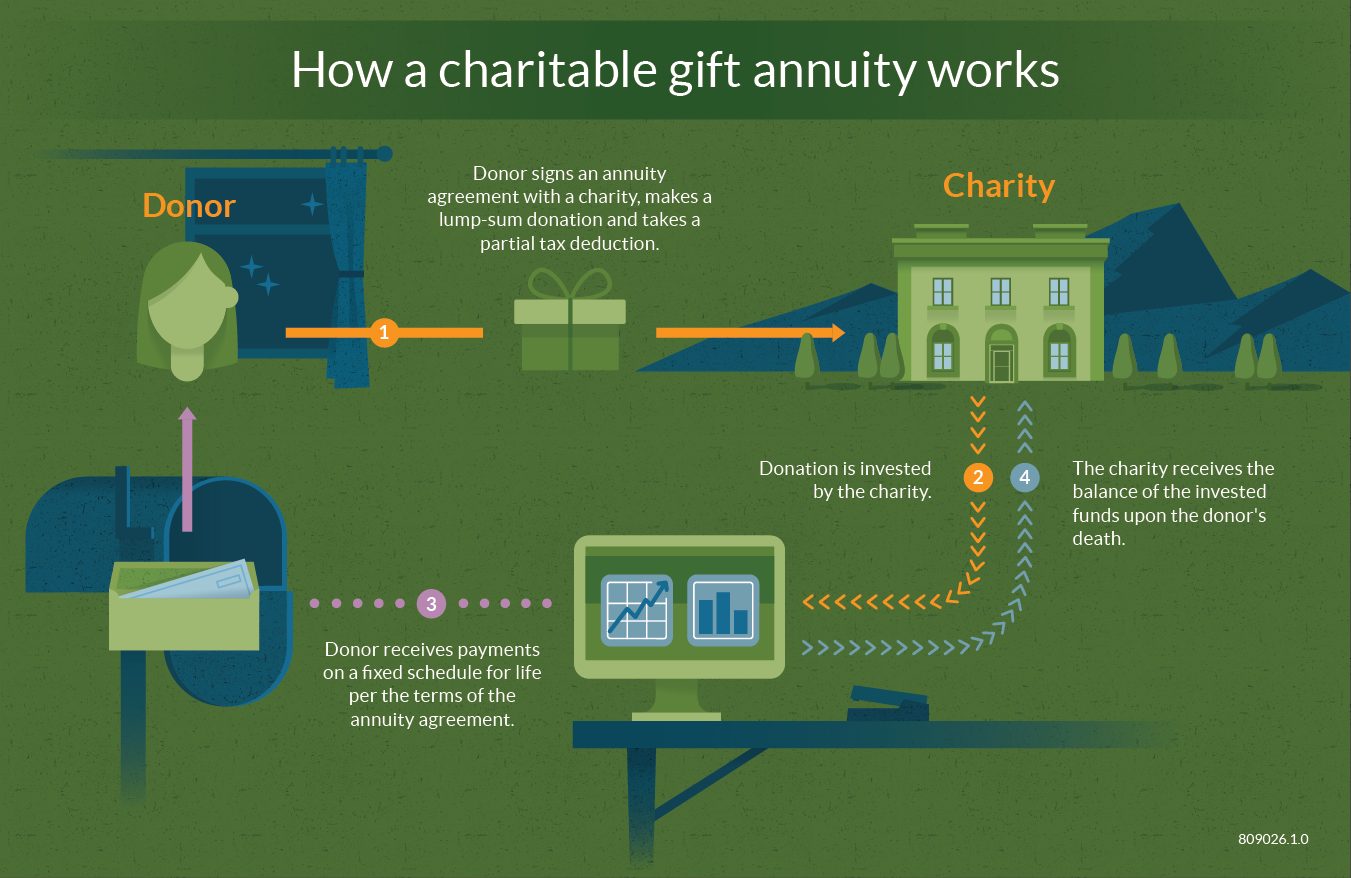

Charitable gift annuities are not regulated by and are not under the jurisdiction of the south dakota division of insurance. In exchange, the charity assumes a legal obligation to provide you and up to 1 additional beneficiary with a fixed amount of monthly income that continues until the last beneficiary dies.

Charitable Gift Annuities Studentreach

Hadassah’s criteria to establish a charitable gift annuity:

Charitable gift annuity minimum age. It requires only a modest contribution ($5,000 minimum) and can be funded with cash or securities. 65 years old (immediate payment); It is the gift that gives back and is a very popular financial plan for several reasons.

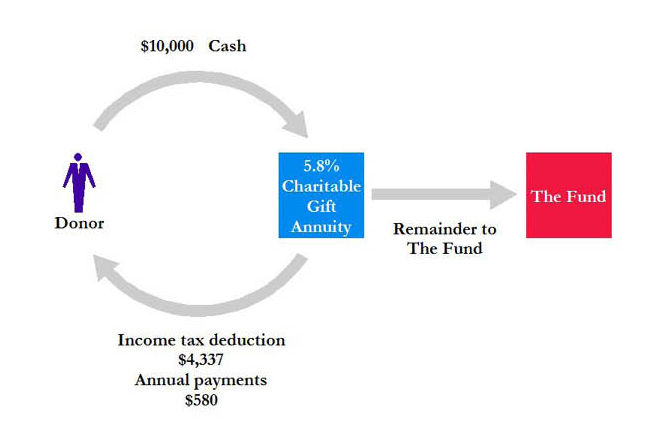

Creating a charitable gift annuity. Many require donors to contribute a minimum of $10,000 to $25,000 and to be at least age 65 to begin receiving payments, says laurie valentine, of the american council on gift annuities. Once the gift annuity is established, it pays a fixed sum annually to one or two people for life.

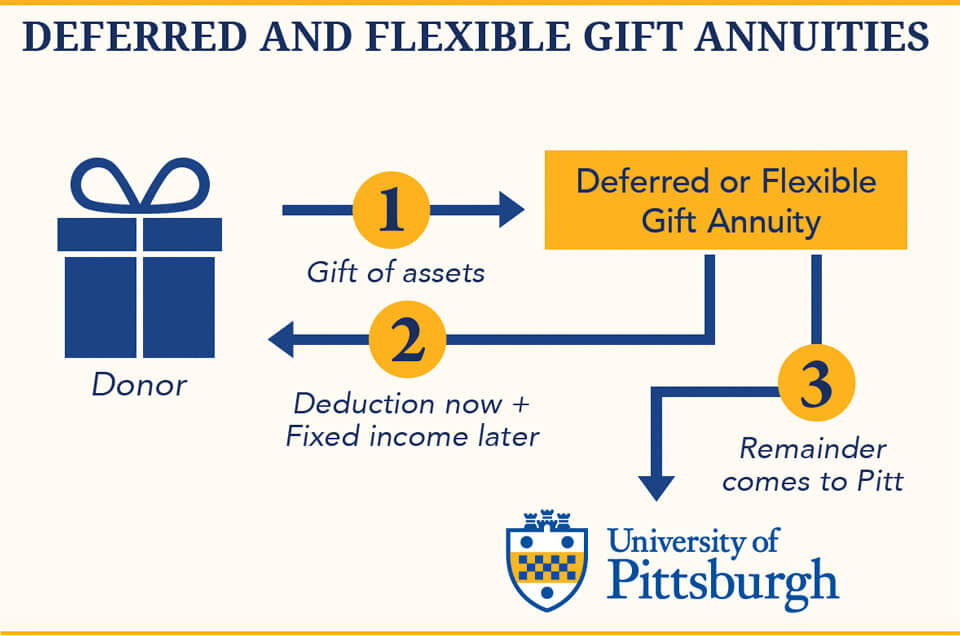

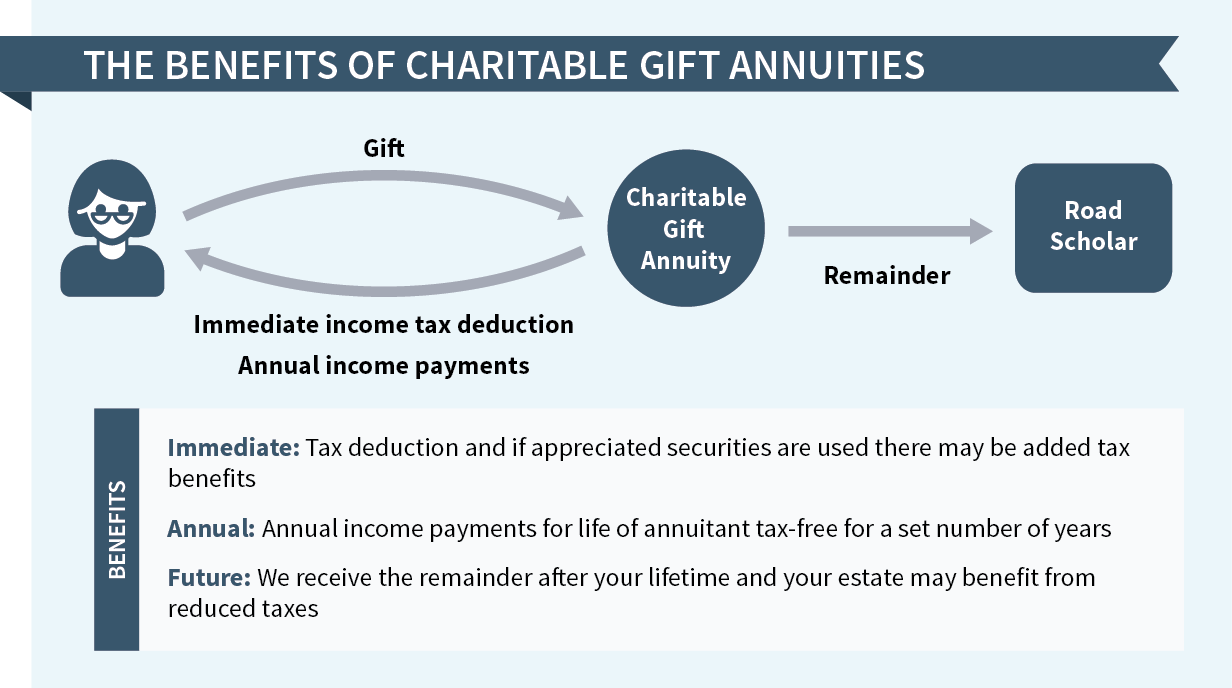

A charitable deduction is available for a portion of your contribution on your income tax return in the year you make the gift. You may receive an immediate income tax deduction for a portion of the gift. If the annuity is deferred, it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an immediate gift annuity.

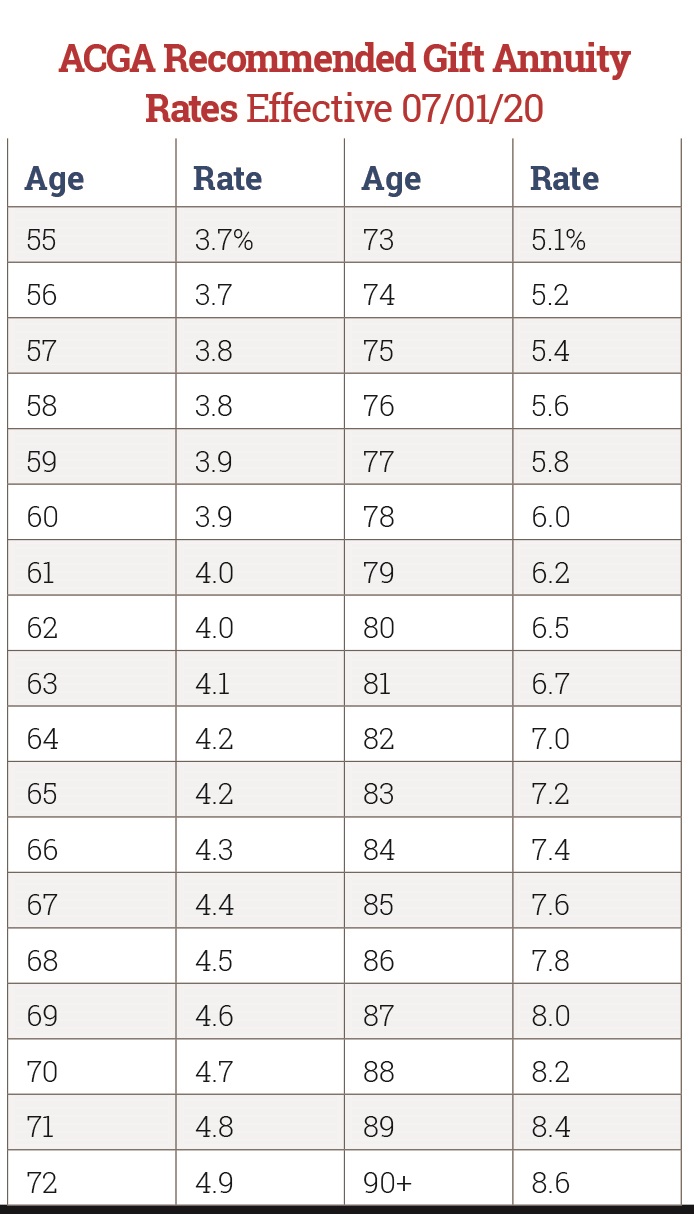

The 20% minimum pv requirement has the effect of reducing rates for annuitants age 59 and under. Fixed rate according to your age; If the annuity is deferred, it is recommended the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an immediate gift annuity.

Charitable organizations considering a gift annuity program are well advised to establish a minimum gift amount. A charitable gift annuity can be set up either by individuals or couples in which you are called the “annuitants.” the funds for your annuity might be cash, securities, gifts, etc. This allows you to make a gift with payments to begin at a future date—at least one year after the gift is made.

Charities must use the gift for a specific initiative if the donor specified one when they made the donation. Minimum age of an annuitant of an immediate gift annuity.2 the philanthropy protection act of 1995 requires a disclosure statement must be received by the donor in. If the sole annuitant will be nearest age 65 on the annuity starting date and the compound interest factor is 1.320577, the deferred gift annuity rate would be 1.320577 times 4.2%, or 5.5%

When you die (alongside your spouse if you gave us a couple), the charity gets the remainder of such a gift. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Future annually income partially tax free;

12 rows charitable gift annuities when you establish a charitable gift annuity with the. For more information, please refer to our charitable gift annuity policy. Benefits of giving support favorite charities or causes.

The charitable gift annuity is a simple contract between donors who are at least 50 years of age and youth in need. The minimum gift is $10,000, and the minimum age when payments may begin is 55. The minimum required gift for a charitable gift annuity is $10,000.

9 the term person includes charitable organizations. Minimum gifts for establishing a charitable gift annuity may be as low as $5,000, but are often much larger. Immediate gift annuity rate for the nearest age or ages of a person or persons at the annuity starting date.

Your age is required to calculate your gift annuity illustration. Pcf is licensed to offer charitable gift annuities to benefit both pcf and other local nonprofit organizations, including the pasadena humane society, a noise within, five acres, and many more. By definition, a charitable gift annuity is what is referred to as a “split gift.”

Establish a minimum amount for a gift annuity. These exceptions include a gift of a present interest of the gift tax annual exclusion amount ($12,000 in 2008 and $13,000 for 2009, indexed for inflation) or less to any person during the calendar year. 10 accordingly, even though the donor might be the only annuitant, if the amount transferred less the present value of the annuity exceeds the annual gift tax.

It is designed to help charities realize a minimum value from gifts whose residua will not be realized for many years. Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. The minimum age at which payments may start is 65.

The minimum gift value is set at $5000 though it is often larger. To be determined (deferred payment) a charitable gift annuity (cga) is a way to make a gift to support lafayette while deriving the benefit of a fixed annual payout for life that is backed by the. Based on her age, the gift annuity payout percentage was set at 6%, providing her with an annual income of $1,500 for life.

Gift annuities may be funded with cash or securities. The minimum age at which an annuitant can receive payments is 65. Both the annuity rate and amount are set at the time the gift is made.

In addition to the income stream, annuitants may also be eligible to take a tax deduction at the time of the original gift, based on the estimated amount that will eventually go to the charity after all the annuity payments have been made. Through a charitable gift annuity, you give cash, publicly traded. A charitable gift annuity (cga) supports your favorite nonprofit organization and provides a lifetime of income too!

Charitable Gift Annuity

Guide To Annuity Fees - Fidelity Investments Annuity Investing Shoppers Guide

Charitable Gift Annuities The University Of Pittsburgh

Compelling Stories Market Charitable Gift Annuities Most Effectively

Are There Any Other Types Of Annuities - Due

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuity Rate Increases Texas Am Foundation

Charitable Gift Annuities Giving To Stanford

Gifts That Pay You Income - Girl Scouts Of The Usa

Charitable Gift Annuities Road Scholar

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

What Is Dividend Yield The Motley Fool Annuity Savings Account Best Savings Account

Charitable Gift Annuities Barnabas Foundation

Nyp-giving-planned Giving-gifts That Provide Income Charitable Gift Annuity Nyp

Acga Charitable Gift Annuity Rates

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group

What Is A Charitable Gift Annuity Fidelity Charitable

What Is A Charitable Gift Annuity Actors Fund

Charitable Gift Annuities - Uses Selling Regulations

Comments

Post a Comment